Is SBP income taxable?

SBP benefits are taxed as income to the survivor however the tax rate upon receipt of the annuity will generally be less than the member’s current tax rate. Most insurance plans are the reverse; premiums are paid from after-tax income, while survivors are not taxed on the proceeds.

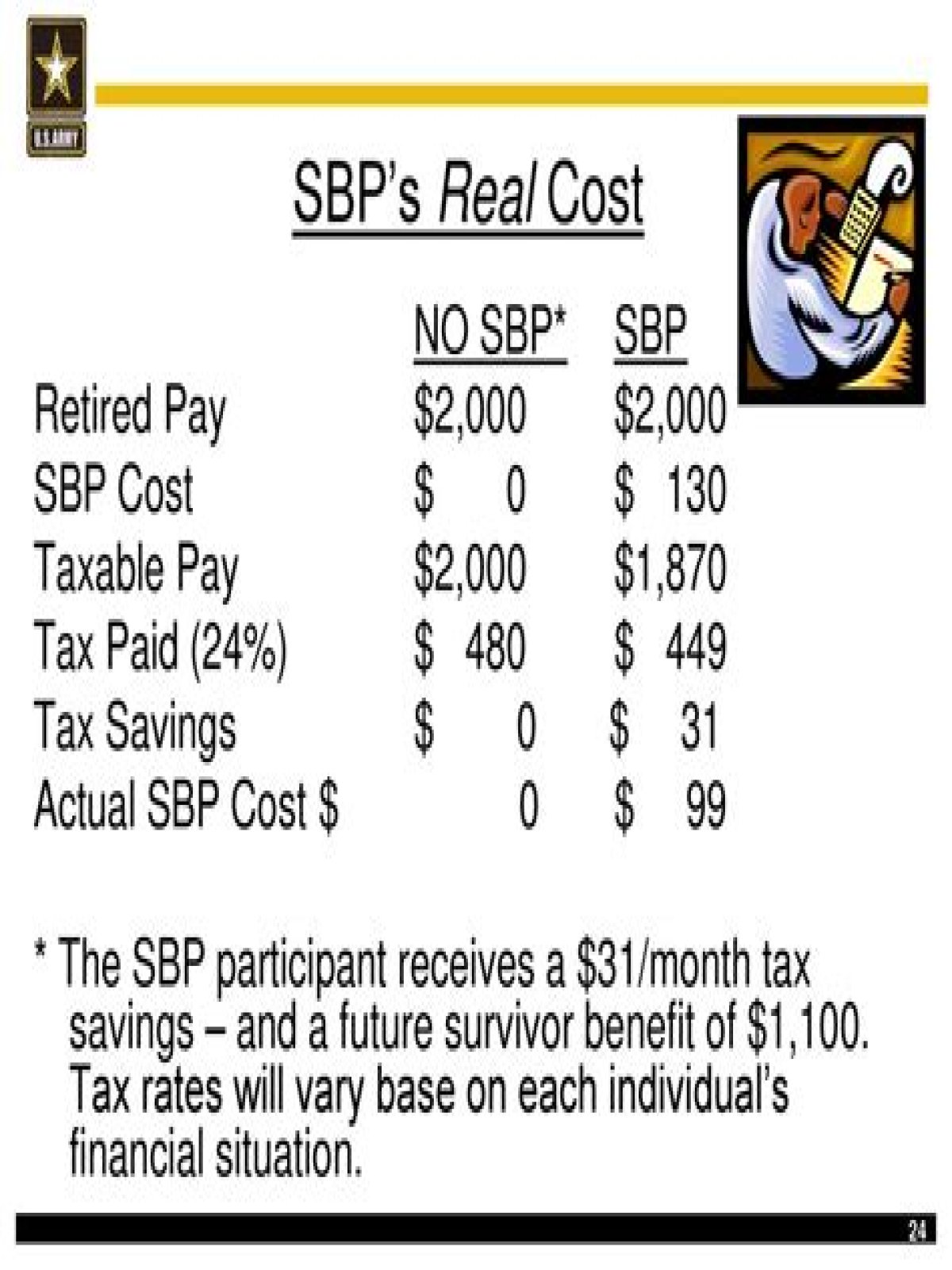

Is SBP tax deductible?

SBP costs are deducted from total retired pay and are excluded from Federal gross income. Thus, the costs are not reported as income to the Internal Revenue Service or taxed.

Is a survivor benefit taxable?

Social Security survivor benefits for children are considered taxable income only for the children who are entitled to receive them, even if the checks are made out to a parent or guardian. Most children do not make enough in a year to owe any taxes.

Are federal benefits taxable?

Federal employees sometimes forget that their federal retirement pension *is* taxable. Your CSRS or FERS Pension will be taxed at ordinary income tax rates. Now – you will get your contributions back tax-free (since you already paid taxes on the money when it was taken out of your pay check).

Is SBP earned income?

On May 21, the Senate passed the Gold Star Family Tax Relief Act (S. 1370; H.R. 2481), which would permanently define SBP distributions to a child as earned income in tax years 2018 and beyond, therefore exempting them from the kiddie tax.

How is SBP calculated?

The SBP premiums for spouse coverage are:

- 6.5% of your chosen base amount, or if less,

- 2.5% of the first $725.00 of the elected base amount (referred to hereafter as the “threshold amount”), plus 10% of the remaining base amount.

How much of Social Security survivor benefits is taxable?

50% How Are Social Security Survivor Benefits Taxed? A child’s social security survivor benefits are taxed if the child’s provisional income is more than the base amount. Provisional income is the sum of these: 50% of social security benefits.