Do I have to report financial aid to IRS?

Other than for work-study positions, the IRS does not receive a 1099 or W-2 form for your financial aid money. The taxable portion of your financial aid is reported on Form 1040 as part of your Adjusted Gross Income.

How do you report financial aid income?

How to Report FAFSA College Money on a Federal Tax Return

- Step 1: Exclude your Pell grant from taxable income.

- Step 2: Include your earnings from a work-study award on your tax return.

- Step 3: Exclude from taxable income any government student loans.

- Step 4: Evaluate any state financial awards you receive.

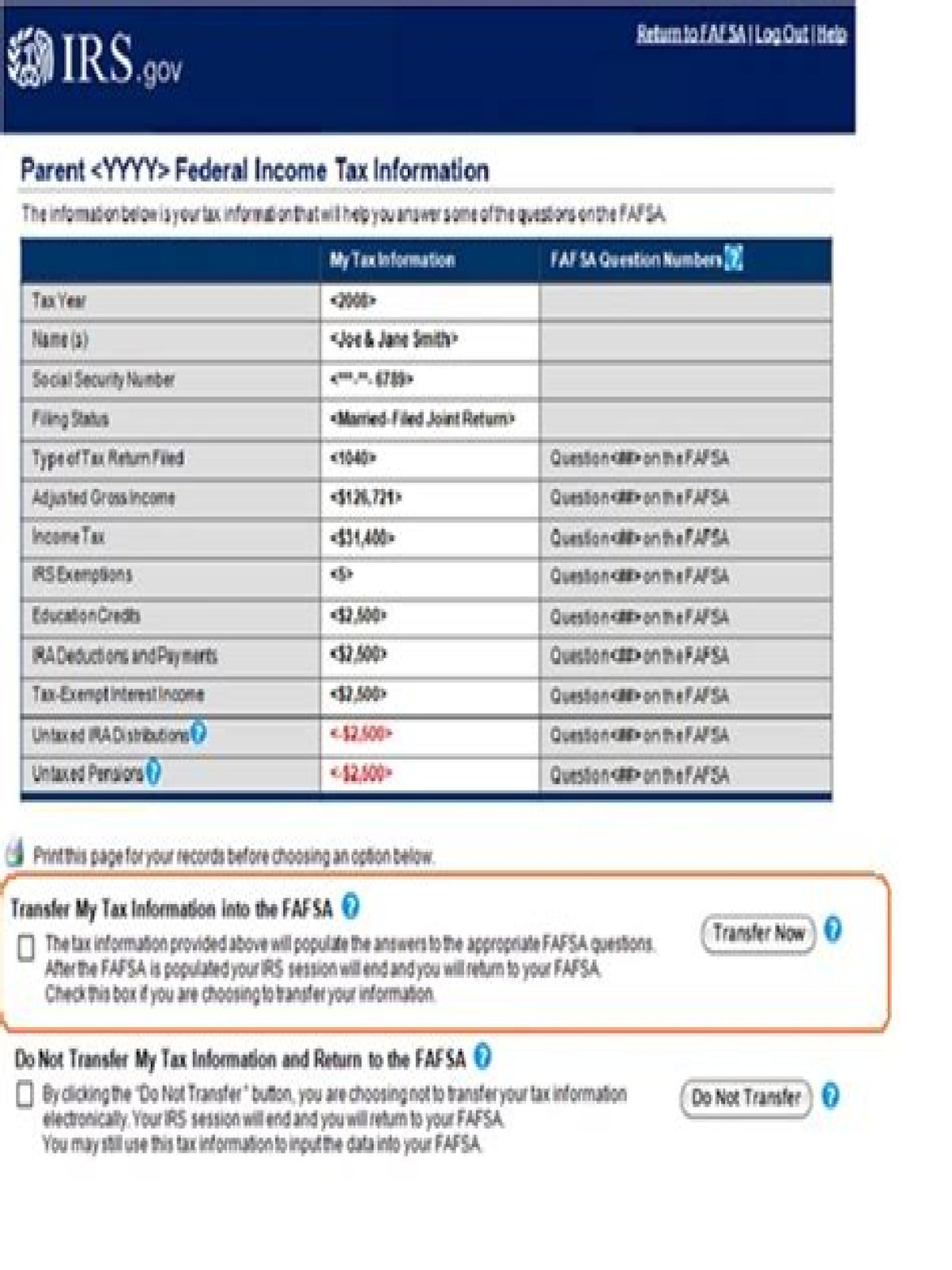

Do you report financial aid on FAFSA?

Do not report the money on your FAFSA unless you included it in your adjusted gross income (AGI). If you did, then report your full AGI on the FAFSA, but report the amount of student aid in the How much taxable grant or scholarship aid did you receive? question.

Do I report student loans on my taxes?

When filing taxes, don’t report your student loans as income. Student loans aren’t taxable because you’ll eventually repay them. Free money used for school is treated differently. You don’t pay taxes on scholarship or fellowship money used toward tuition, fees and equipment or books required for coursework.

Can you make FAFSA corrections after deadline?

Changes You Can Make If you’ve received your Student Aid Report (SAR) and realized that something on your FAFSA® is incorrect, it’s not too late to make changes. You can change most information on your FAFSA® until it closes for the year or before your schools designated deadline.

Do federal Pell grants count as income?

Any portion of your Pell grant that is not spent on qualified education expenses is required to be reported as income on your tax return. If you use your Pell grant to pay for room and board charges, or to travel to your permanent home on weekends or holidays, then the amount will be considered taxable income.