What is domestic production activities deduction IRS?

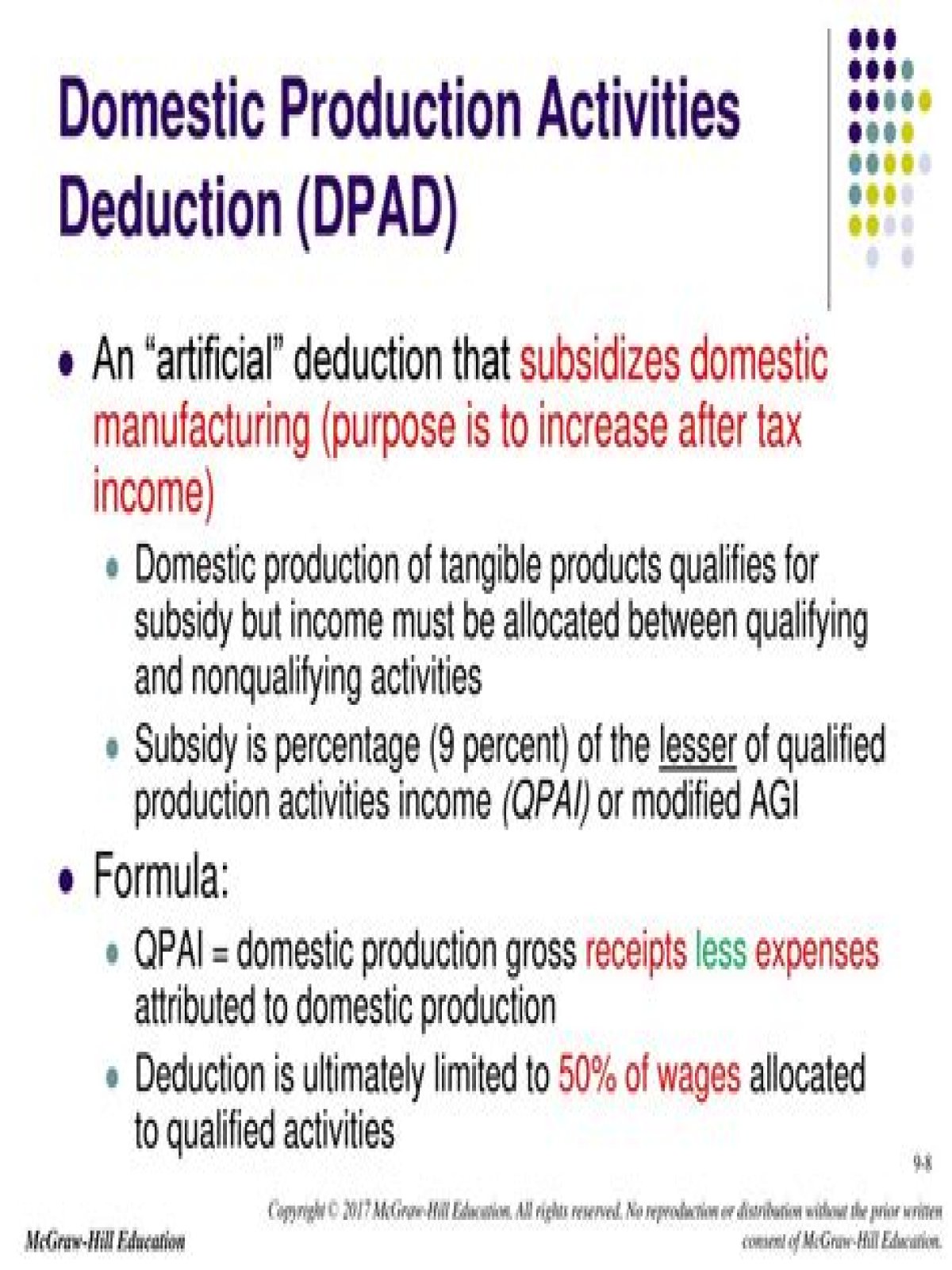

The Domestic Production Activities Tax Deduction is intended to provide tax relief for businesses that produce goods in the United States rather than producing it overseas. The deduction was in effect for tax years 2005 through 2017 and applied to both small and large businesses.

How is Dpad calculated?

The DPAD is 9% of qualified production activity income, equal to the gross receipts from qualified production minus the expenses for creating the product. The deduction is available under both the regular and the AMT tax systems.

What does Dpad stand for?

Domestic Production Activities Deduction What is DPAD? Domestic Production Activities Deduction, otherwise known as DPAD, was enacted as part of the American Jobs Creation Act of 2004 (code section 199). With the purpose of providing a deduction for U.S. businesses, it simultaneously offset the repeal of a tax break for U.S. exporters.

Why is it called a Dpad?

Sega coined the term “D button” to describe the pad, using the term when describing the controllers for the Sega Genesis in instruction manuals and other literature. Arcade games, however, have largely continued using joysticks.

What is a DP ad?

Acronym. Definition. DPAD. Domestic Production Activities Deduction (taxes) DPAD.

What is right on the D-pad for PC?

A circular- or square-shaped pad that provides navigation keys for the four directions: up, down, left and right. These are the equivalent of the “arrow keys” on a computer keyboard and are used for navigating the user interface.

Where can I find instructions for form 8903?

Instructions for Form 8903(Rev. December 2019) Domestic Production Activities Deduction Department of the Treasury Internal Revenue Service Section references are to the Internal Revenue Code unless otherwise noted. Future Developments

How to figure your domestic production activities deduction?

Use Form 8903 to figure your domestic production activities deduction (DPAD). None at this time.

When do I need to use DPad form 8903?

DPAD has been repealed for tax years beginning after 2017. Don’t use Form 8903 to claim DPAD for 2018 or later years unless: 1. Your tax year began before January 1, 2018, 2. You are a shareholder in an S corporation or partner in a partnership and the entity has a tax year that began before January 1, 2018, 3.

Who is required to file DPad for domestic production activities?

Who Must File DPAD for income attributable to domestic production activities be- fore 2018. Individuals, corporations, cooperatives, estates, and trusts use Form 8903 to figure their allowable DPAD from certain trade or business activities.